Sustainable Investment policy

Home » About UJ » ESG Impact » Environmental Impact » Environmental Sustainability » Sustainable Investment policySustainable Investment Policy

UJ Finance and Investment Policy

UJ Investment Policy / Strategy Statement

UJ Investment Strategy Statement

“This statement is intended to explain and summarise the investment strategy of the University of Johannesburg Pension Fund (the fund) to members. The complete investment strategy document is available on the Fund intranet at: https://universityofjohannesburg.us/4ir/uj-pension/

The fund is a defined contribution pension fund. Members participate directly in the investment performance of the fund’s investments and retirement outcomes are not guaranteed.

The fund informs members of the level of retirement income they could reasonably expect to purchase at retirement, given their existing retirement savings in the fund, their current contribution to the fund and expected future investment returns. Various assumptions are made to project retirement outcomes and these outcomes are not guaranteed.

The fund uses a goals-based life-stage investment model where members’ retirement savings are gradually moved from the fund’s growth portfolio to the pre-retirement portfolio from five years before normal retirement age. The fund uses the growth portfolio to try to achieve a long-term real return of CPI + 6% per annum. To stand a good chance of achieving this return, the portfolio has a relatively large exposure to share markets and the investment risks associated with these markets. This is the default investment portfolio for younger members.

As members get closer to retirement, the default strategy is for retirement fund assets to be invested more conservatively to reduce the risk of capital loss. Members can opt out of the life-stage model and can then select portfolios from the investment choices available to members of the fund. Members can ask their HR representative for the member investment choice booklet if they are interested in this option.

The fund participates in pooled investment portfolios together with other retirement funds. These investment portfolios are provided and managed by the fund’s appointed asset managers. The trustees frequently monitor the performance of the fund’s investment portfolios and, should the trustees believe it to be appropriate to do so, the trustees will replace the manager or investment portfolios with more suitable manager(s) or investment portfolios.

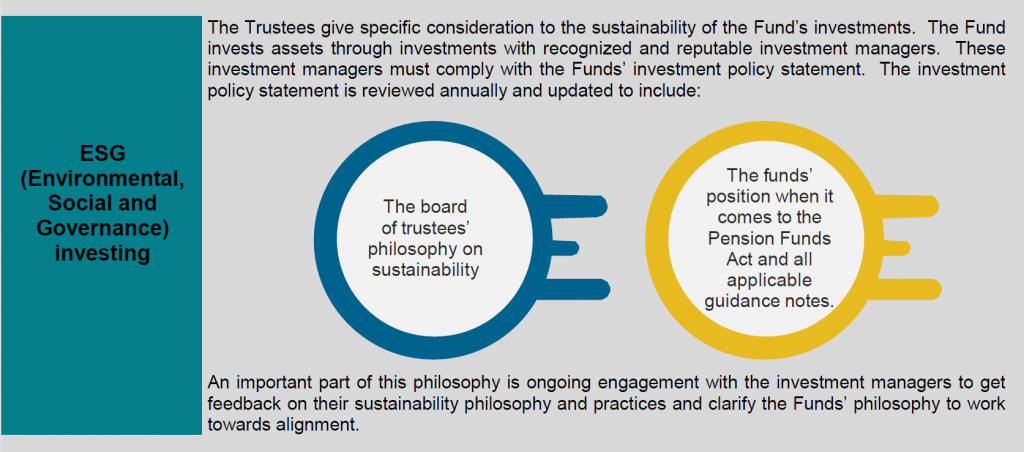

The trustees believe that material extra-financial factors relating to environmental, social and governance (ESG) issues can affect the performance of investment portfolios. Responsible investing is an approach that incorporates these material extra-financial factors into investment processes and activities with the objective of decreasing investment risk and improving risk-adjusted returns. Active ownership requires the fulfilment of ownership duties in order to give effect to the above responsible investment approach.

The responsibility for the management of the fund’s assets has been delegated to the asset managers appointed by the fund and these managers will be interrogated about their active ownership approach including, engagement and proxy voting record, as well as their ESG policies. Asset managers are required to exercise active ownership responsibilities on behalf of the fund to positively influence the underlying companies in areas such as sustainability through proxy voting and other engagement.

The fund has also made certain retirement product options available to members in line with default regulations. More details are available in the fund’s relevant ‘options on retirement’ and ‘options on leaving’ fund booklets.

The trustees will review the fund’s investment strategy at least every year to ensure that it remains appropriate for the fund and its members.”